Interbank Division

The call money market was originally established and developed as a means for banks to adjust their liquidity with each other. It is the oldest money market in Japan. The call market is so named because funds are returned whenever the lender “calls”. It is used for lending and borrowing with the term of less than one year.

Uncollateralized call

This fund transaction that does not require any collaterals was introduced in 1985 with the deregulation and internationalization of the money market. The weighted-average interest rate on overnight uncollateralized call transactions, or “TONA” (dubbed from “Tokyo Overnight Average Rate”) is designated as the risk-free rate for the Japanese yen, and is again subject to the Bank of Japan’s Guideline for Market Operations following the lifting of its negative interest rate policy in March 2024. Therefore, it has become an extremely important indicator of short-term interest rates in Japan.

Collateralized call

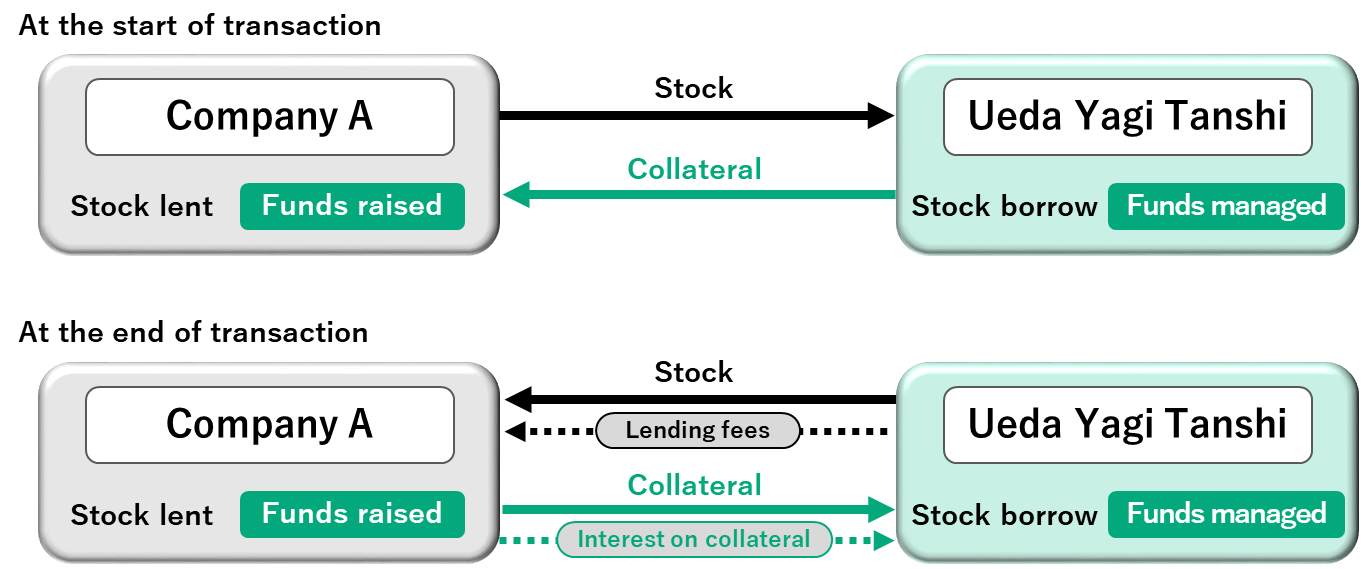

Collateralized calls are highly secure collateralized fund transactions invented by Kaname Ueda, the Company’s founder. The transaction types are broadly separated into two types: “dealing method” (the tanshi company acts as a principal in the transaction) and “broking method” (the tanshi company acts as a broker in the transaction).

Intraday call

Intraday call transactions are concluded in the same day. They are primarily used to balance shortage or surplus of funds due to timing differences in fund inflows and outflows during a day and settlements by private-sector settlements systems, such as Foreign Exchange Yen Clearing System (FXYCS) and Zengin-Net.

Interbank Division

Tel: +81(3)-3270-1711